Changes to Property Transfer Tax for First-Time Buyers in BC

If you bought your first home in British Columbia within the last 18 months or are planning to buy your first place in BC, you're going to want to read this blog on the recent changes that were announced this month from the BC provincial government.

The B.C. government recently announced changes to the property transfer tax that's applied to first-time homebuyers.

Previously, the rule was if you purchased a home only up to $500,000, you could waive the property transfer tax that's applicable to that home purchase with a discount rebate between $501K and $524K. Any home price at or above $525K and you would be on the hook for the entire tax bill.

The B.C. government recently decided to increase this threshold from a $500,000 purchase price to $835,000 with a partial exemption from $835,000 to $860,000.

So now, if you're purchasing a home at $835,000, you're going to be able to waive the property transfer tax on the first $500,000 of that purchase price. This is going to equate to a rebate of $8,000.

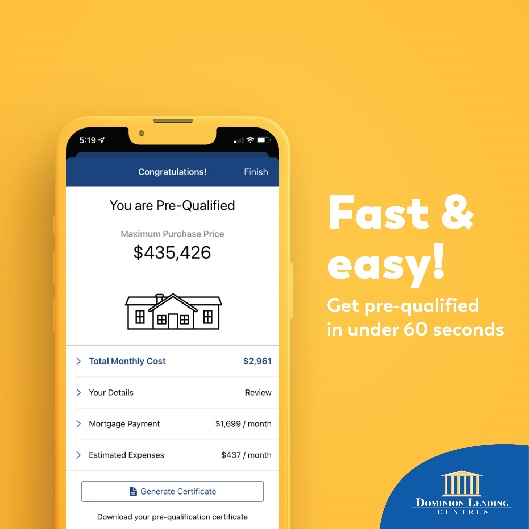

If you’re currently shopping for your first home and you’d like some help determining what your property transfer tax will be, you can use our Property Transfer Tax Calculator found in our mobile app. There’s also a ton of other info (shop rates, get pre-qualified, down payment calculator etc.) that will really you on your home ownership journey.

Now, here’s some important info if you recently bought your first home in the last 18 months before these changes and paid the full property transfer tax.

The B.C. government has yet to come out with expressed legislation and rules around this recent change.

However, if they don't expressly state that a rebate is not possible for those who have purchased a home in the previous past, then you will be able to apply for a rebate to get your property transfer tax refunded to you as long as you purchased a home within the last 18 months.

To apply for this rebate, send us an email and we’ll be happy to send you over the form that you’ll need to apply to get this rebate back in your pocket.

If you have any questions about your specific situation, just give us a call, shoot us an email, or get a hold of us on social media.

To learn more here are some links to additional information: