5 Tips to Prepare You for Your First Pre-approval in 2023

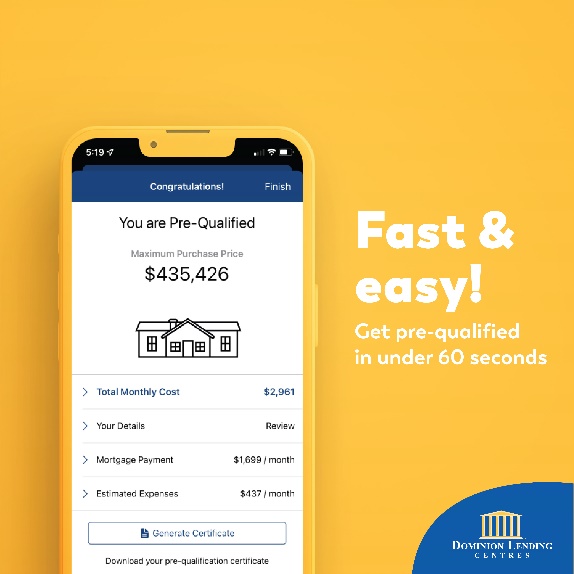

If you’re a first-time buyer preparing for your first purchase, you’re going to need to get pre-approved to know where you stand on the home-buying scale.

To help you prepare for this important step in your real estate journey, here is a list of tips to make the most out of your mortgage conversations:

Know Your Budget

Nowadays with interest rates at 22-year highs, there may be a big difference between what you are approved for on a home purchase, and what you can afford.

During our meeting, we will advise on how you can make your home purchase as affordable as possible but before we can make these suggestions, we need to know what kind of payment is manageable and what will make you ‘house poor’.

So before scheduling your mortgage appointment, it is imperative that you have a grasp on your finances and what you afford to pay every month for a place to live.

A practical step is to do a monthly budget. Add up all your expenses, categorize them (Food, shelter, entertainment, etc.), and figure out what you could give up to make your home dreams come true.

Have a Chat with Family

For those attempting to buy in highly-priced areas like Vancouver, Victoria, or Kelowna, a significant number of first-time buyers will either be receiving a cash gift from their parents to help with their down payment, or have family co-sign to increase their purchase price.

Make sure you have a conversation with family to let them know you are in the process of getting ready to buy your first place.

If they are willing and able to help by either providing a gift or by co-signing, this is an important detail you will want to know before you have a meeting with your mortgage broker.

Address Any Credit Issues

It happens. Sometimes we forget to make that cell phone bill payment or we’re one-day late on our credit card statement.

Although missing one bill payment won’t deny you for a mortgage, a consistent track record of missing these payments could result in either being declined or could cost you in the way of a higher interest rate.

So if you’ve struggled in the past with making your payments on time, my suggestion is to put all of your bills on auto-payment. This is a simple solution that will help you avoid the headache of having to remember and will help ensure your credit score continues to climb.

Lastly, it may go without saying that you will want to settle any collections, consumer proposals, or bankruptcies well in advance of getting pre-approved for a home.

Make Sure Your Taxes are Filed and Paid

Let’s be honest for a second. Taxes suck.

But if you want to buy a home, it’s advised that you make sure you’re up to date on them especially if you’re self-employed.

Come Loaded with Questions and Ready to Take Notes

When you went to school, what did you bring with you? No, I’m not talking about the ham and cheese sandwich in your bag.

You brought your notebook. Why? Because you want to remember what you learned and the answers to the questions you have.

If you’ve never bought a home before, you should approach your real estate meetings - like the ones with your mortgage broker, real estate agent, or lawyer - as if you were going to school. These meetings will be the education you gain going through your first real estate purchase.

Go into your meeting with a list of questions and be prepared to take notes either from an actual notebook or using a tab in your phone. From my experience working with 1000’s of clients over my career, those who take the time to take notes have had the most success in accomplishing their goals effectively and efficiently with less stress along the way.

Yes, we are always here to remind you of what you need to know and make sure you avoid any pitfalls but at the end of the day this is your home purchase and you should take responsibility for that by helping yourself avoid mistakes.

Have questions or looking to get started on your pre-approval?

Shoot us an email or schedule a call with us today to begin your real estate journey today.

Article written by: Cody Rowe

Mortgage Consultant

Dominion Lending Centres - Modern Mortgage Group

Keywords: First-time buyer, first time buyer mortgage, mortgage pre-approval, mortgage broker victoria