How to Buy Your First Home in Canada in 2023

Buying your first home is an exciting and significant milestone in anyone's life, and it's essential to approach the process with careful consideration and planning.

If you're looking to purchase your first home in Canada in 2023 and not sure where to start, here is a detailed list of steps to follow.

- Determine your budget: The first step in buying a home is to figure out how much you can afford. Consider your income, expenses, and savings to determine how much you can comfortably spend on a home. Don't forget to factor in additional costs like property taxes, home insurance, utilities and maintenance.

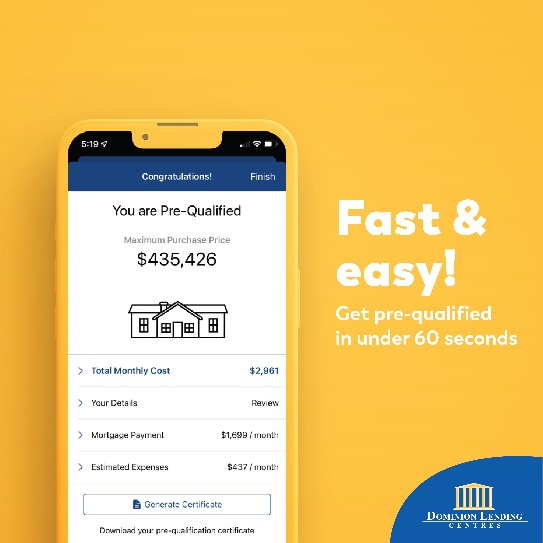

- Get pre-approved for a mortgage: Once you have a budget in mind, it's important to get pre-approved for a mortgage. This will give you a better idea of how much you can borrow and what your monthly payments will be. Especially in today’s market, it's important to shop around for the best mortgage rates and terms. If you’re looking for help with that, click here to download our mortgage app to shop rates, or here to schedule a chat with a mortgage advisor.

- Research neighborhoods: Before you start looking at homes, research different neighborhoods to find one that suits your needs and budget. For lifestyle reasons but also to maximize the value of your investment consider factors like proximity to public transportation, schools, shopping, and entertainment.

- Start house hunting: Once you've determined your budget and identified neighborhoods you're interested in, it's time to start looking at homes. Work with a real estate agent to find properties that meet your needs and budget. Don't be afraid to ask questions and take your time to find the right home. If you are only buying and not selling a home, a real estate agent is a free service. Need a referral to a real estate agent? Just reach out by email or give us a call.

- Make an offer: If you've found a home you love, it's time to make an offer. Work with your real estate agent to determine a fair price based on comparable homes in the area. Be prepared to negotiate and make a counteroffer if necessary. Under normal circumstances, you’ll be given a subject removal period to complete any due diligences such as an confirming financing, reviewing strata documents or getting a home inspection before fully committing to the purchase.

- Get a home inspection: Once you've found a home you're interested in, it's imperative to get a home inspection. This will help you identify any potential issues with the property and ensure that you're making an informed decision. You may also be able to negotiate the price down further if any defects are spotted.

- Remove your subjects: Once you have finalized the mortgage, and done your due diligences in step 5, it’s time to remove your subjects and commit to the purchase. Prior to this, it's important to review all documents carefully and ask any questions you may have as you will be expected to provide a non-refundable deposit once you remove your subjects.

- Lawyer’s Meeting: This is the final step. Your mortgage and sale agreement will be sent to your lawyers office, where they will register title in your name and go over any additional paperwork with you. Especially for the first purchase, make sure you work with a lawyer and not a notary so you are working with someone who can provide legal advice.

- Close the deal and move in: Congratulations, you're a homeowner! It's time to collect your keys and start making your new house a home. Don't forget to budget for moving expenses and any necessary renovations or repairs.

Buying your first home can be a daunting process, but by following these steps, you can approach the process with confidence and make an informed decision.

Remember to take your time, do your research, and rely on professionals like real estate agents, and a mortgage broker to ensure that you find the perfect home for your needs and budget.